Posts

U.S. Home Sale Profits Remain High But Take Unusual Fall In Second Quarter

IRVINE, Calif. – July 29, 2021 — ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Home Sales Report, which shows that profit margins for home sellers took an unusual dip in the second quarter but still were far above where were they were a year earlier. In a sign…

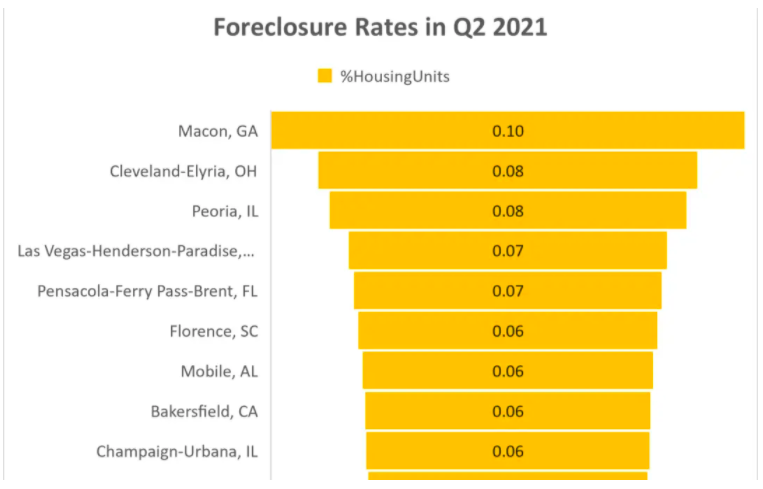

Top 10 U.S. Metros with Highest Foreclosure Rates in Q2 2021

ATTOM’s newly released Midyear 2021 U.S. Foreclosure Market Report shows that foreclosure filings in the first six months of 2021 were down 61 percent from the same time period a year ago and down 78 percent from the same time period two years ago. According to ATTOM’s latest foreclosure activity analysis, with just 65,082 U.S. properties with foreclosure filings…

Foreclosure Sale Discounts Rising Across U.S.

The key takeaways from ATTOM Data Solutions’ newly released November 2020 U.S. Foreclosure Market Report revealed that foreclosure filings were down 14 percent from October 2020, Florida posted the highest foreclosure rate and greatest number of REOs, and while foreclosure starts were down across the nation, a few states did see monthly increases in November…

Homeownership Slips Into Unaffordable Territory Across Majority of U.S. in Fourth Quarter of 2020

IRVINE, Calif. – November 10, 2020 —ATTOM Data Solutions, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), a foreclosure listings portal, today released its October 2020 U.S. Foreclosure Market Report, which shows there were a total of 11,673 U.S. properties with foreclosure filings — default notices, scheduled auctions or…

U.S. Properties with Foreclosure Filings on the Rise as Pandemic Remains a Threat to Economy

IRVINE, Calif. – November 10, 2020 —ATTOM Data Solutions, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), a foreclosure listings portal, today released its October 2020 U.S. Foreclosure Market Report, which shows there were a total of 11,673 U.S. properties with foreclosure filings — default notices, scheduled auctions or…

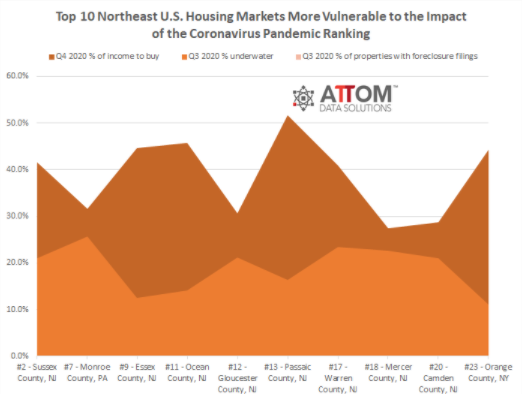

Top 10 Northeast U.S. Housing Markets More Vulnerable to the Impact of the Coronavirus Pandemic

According to ATTOM Data Solutions’ newly released Q4 2020 Special Coronavirus Report spotlighting county-level housing markets around the U.S. that are more or less vulnerable to the impact of the virus pandemic, pockets of the Northeast and other parts of the East Coast remained most at risk in Q4 2020, while the West continued to…

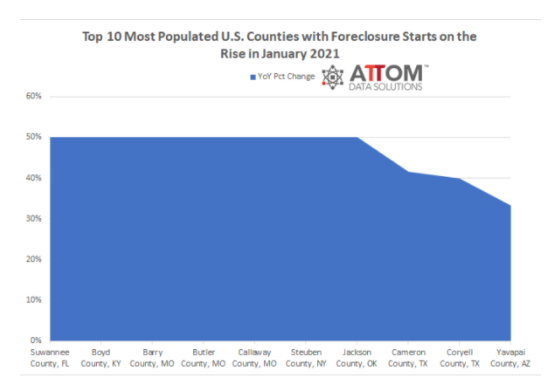

Top 10 Most Populated U.S. Counties with Foreclosure Starts on the Rise

According to ATTOM Data Solutions’ newly released January 2021 U.S. Foreclosure Market Report, there were a total of 9,702 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — reported in January 2021. That figure was down 11 percent from December 2020 and 80 percent from January 2020. ATTOM’s latest…

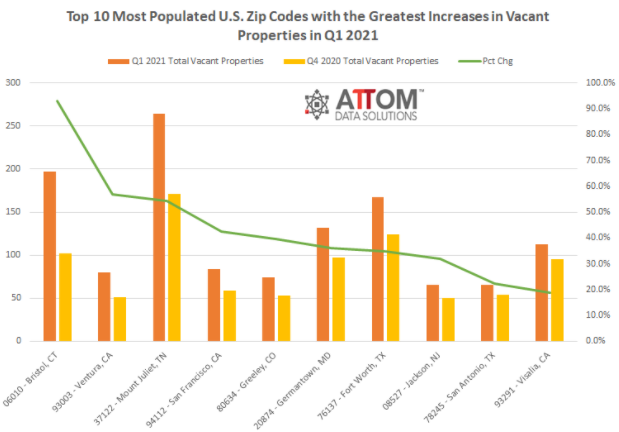

Top 10 Zip Codes with Greatest Increases in Vacant Properties in Q1 2021

According to ATTOM Data Solutions’ new Q1 2021 Vacant Property and Zombie Foreclosure Report, there are just over 1.4 million U.S. residential properties sitting vacant in Q1 2021, representing only 1.5 percent of all homes. The report noted the number of pre-foreclosure homes sitting empty or “zombie foreclosures” is just 6,677. That figure is down…

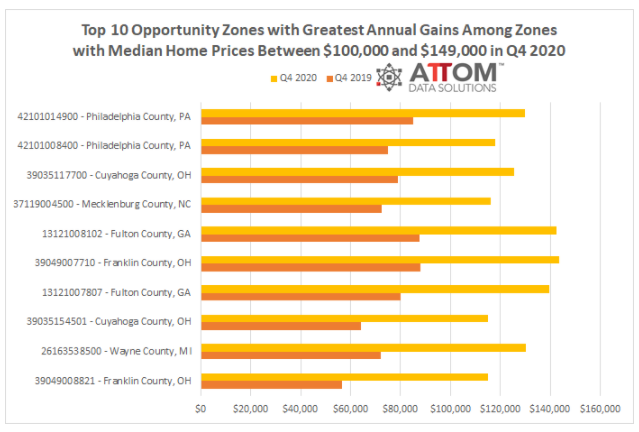

Top 10 Opportunity Zones with the Greatest Annual Gains

ATTOM Data Solutions’ recently released Q4 2020 Opportunity Zones Report found that among the qualified Opportunity Zones designated by the Tax Cuts and Jobs Acts of 2017, median home prices increased from Q4 2019 to Q4 2020 in 77 percent of those designated zones with sufficient data. The report also found that median prices rose…

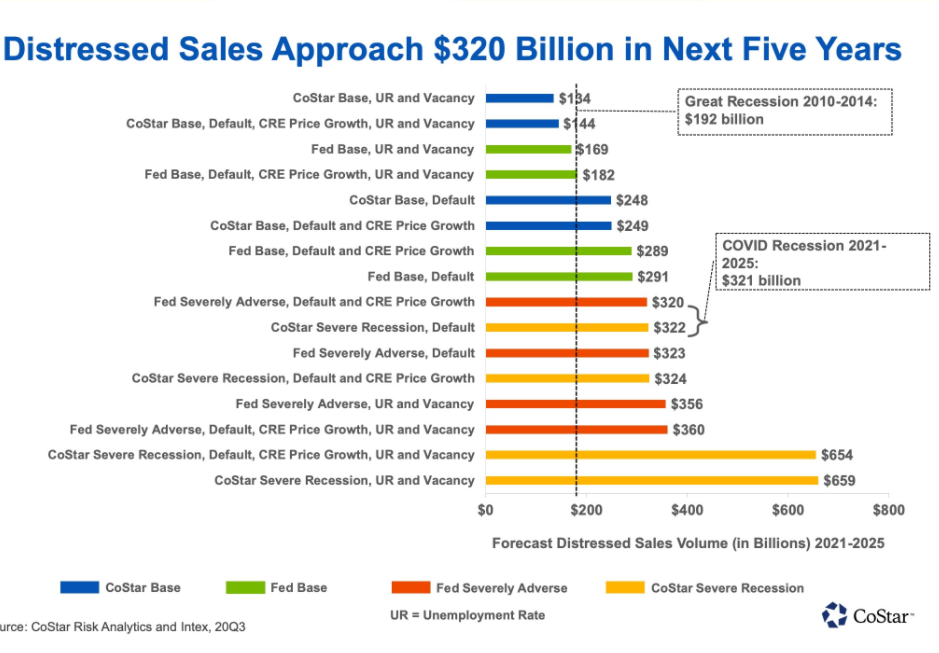

The Long Term NPL Effects of COVID-19 Projections

The zombie effect and lasting impacts COVID-19 has led to broad economic contraction, which has also been seen in NPL markets. Because NPLs are such a slow-moving market, many of the sales in the US and Europe prior to COVID were still due to the 2008 financial crisis, and COVID has slowed down that offloading…